Expo

view channel

view channel

view channel

view channel

Medical Imaging

AICritical CareSurgical TechniquesPatient CareHealth ITPoint of Care

Events

Webinars

- Wearable Device for Diabetics Could Replace Continuous Glucose Monitoring Systems

- AI Stethoscope Spots Heart Valve Disease Earlier Than GPs

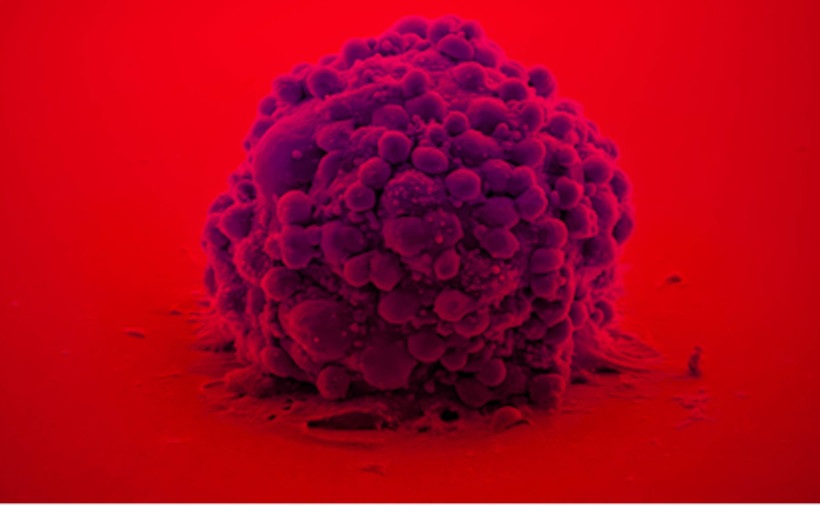

- Bioadhesive Patch Eliminates Cancer Cells That Remain After Brain Tumor Surgery

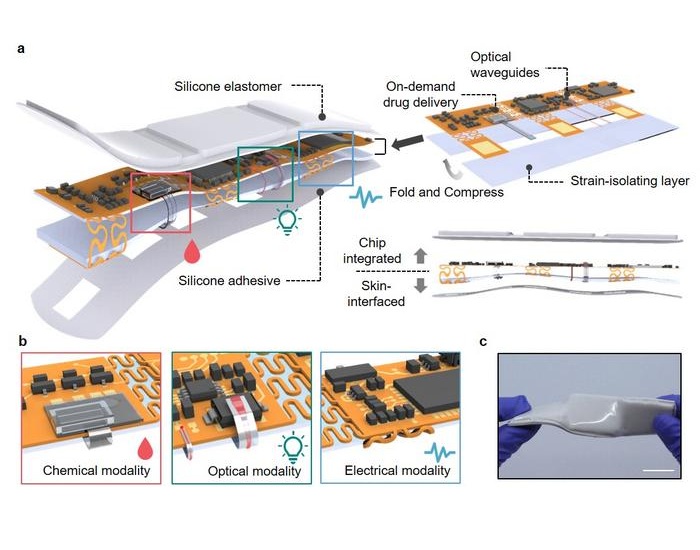

- Wearable Patch Provides Up-To-The-Minute Readouts of Medication Levels in Body

- Living Implant Could End Daily Insulin Injections

- Neural Device Regrows Surrounding Skull After Brain Implantation

- Surgical Innovation Cuts Ovarian Cancer Risk by 80%

- New Imaging Combo Offers Hope for High-Risk Heart Patients

- New Classification System Brings Clarity to Brain Tumor Surgery Decisions

- Boengineered Tissue Offers New Hope for Secondary Lymphedema Treatment

- VR Training Tool Combats Contamination of Portable Medical Equipment

- Portable Biosensor Platform to Reduce Hospital-Acquired Infections

- First-Of-Its-Kind Portable Germicidal Light Technology Disinfects High-Touch Clinical Surfaces in Seconds

- Surgical Capacity Optimization Solution Helps Hospitals Boost OR Utilization

- Game-Changing Innovation in Surgical Instrument Sterilization Significantly Improves OR Throughput

- Medtronic and Mindray Expand Strategic Partnership to Ambulatory Surgery Centers in the U.S.

- FDA Clearance Expands Robotic Options for Minimally Invasive Heart Surgery

- WHX in Dubai (formerly Arab Health) to debut specialised Biotech & Life Sciences Zone as sector growth accelerates globally

- WHX in Dubai (formerly Arab Health) to bring together key UAE government entities during the groundbreaking 2026 edition

- Interoperability Push Fuels Surge in Healthcare IT Market

Expo

Expo

- Wearable Device for Diabetics Could Replace Continuous Glucose Monitoring Systems

- AI Stethoscope Spots Heart Valve Disease Earlier Than GPs

- Bioadhesive Patch Eliminates Cancer Cells That Remain After Brain Tumor Surgery

- Wearable Patch Provides Up-To-The-Minute Readouts of Medication Levels in Body

- Living Implant Could End Daily Insulin Injections

- Neural Device Regrows Surrounding Skull After Brain Implantation

- Surgical Innovation Cuts Ovarian Cancer Risk by 80%

- New Imaging Combo Offers Hope for High-Risk Heart Patients

- New Classification System Brings Clarity to Brain Tumor Surgery Decisions

- Boengineered Tissue Offers New Hope for Secondary Lymphedema Treatment

- VR Training Tool Combats Contamination of Portable Medical Equipment

- Portable Biosensor Platform to Reduce Hospital-Acquired Infections

- First-Of-Its-Kind Portable Germicidal Light Technology Disinfects High-Touch Clinical Surfaces in Seconds

- Surgical Capacity Optimization Solution Helps Hospitals Boost OR Utilization

- Game-Changing Innovation in Surgical Instrument Sterilization Significantly Improves OR Throughput

- Medtronic and Mindray Expand Strategic Partnership to Ambulatory Surgery Centers in the U.S.

- FDA Clearance Expands Robotic Options for Minimally Invasive Heart Surgery

- WHX in Dubai (formerly Arab Health) to debut specialised Biotech & Life Sciences Zone as sector growth accelerates globally

- WHX in Dubai (formerly Arab Health) to bring together key UAE government entities during the groundbreaking 2026 edition

- Interoperability Push Fuels Surge in Healthcare IT Market